- Resilient business with continued strong cash generation -

- Improving demand in important North American marketplace -

- Strong financial platform to innovate and drive inorganic growth -

Oxford Metrics plc (LSE: OMG), the international software company servicing infrastructure, life sciences, entertainment and engineering markets, announces interim results for the six months ended 31 March 2021.

| H1 FY21 |

H1 FY20 |

|

| Revenue | £15.3m | 15.0m |

| Annualised Recurring Revenue | £7.1m | £6.8m |

| Adjusted Profit before Tax* | £1.3m | £0.3m |

| Adjusted* Basic Earnings per Share | 1.08p | 0.17p |

| Statutory Profit/(Loss) before Tax | £1.0m | (£0.1m) |

| Statutory Basic Earnings per Share | 0.81p | (0.17p) |

| Net Cash | £15.9m | £10.8m |

| Operating Cashflow | £4.2m | £1.0m |

| Cash as at 25 May 2021 | £19.1m | - |

* Profit/(loss) Before Tax from continuing operations before Group recharges adjusted for share-based payments, amortisation of intangibles arising on acquisition, change in fair value of deferred consideration payable and unwinding of associated discount factor, Pimloc and exceptional costs

Commenting on the results Nick Bolton, Chief Executive said:

“Oxford Metrics has traded well in the first half delivering both revenue and profit improvements, with key metrics tracking ahead. Strong cash generation has continued providing the Group with a resilient platform to operate through the challenging environment.

The pandemic has accelerated positive market drivers in both of our businesses which we are well placed to capitalise on. With a broader range of motion measurement applications continuing to emerge, including taking virtual production to new heights, Vicon has continued to innovatively push boundaries and the need for Yotta’s software solutions continues as customers look to digitally transform and seamlessly manage their public assets remotely.

While restrictions continue to vary in many of the countries we serve, we have been encouraged by the return to more normal levels for Vicon’s markets, particularly in the USA, and, for Yotta, we expect a return to more normal trading conditions in the second half.

The Group enters the second half with strong fundamentals and a robust balance sheet to drive both organic and inorganic growth. We do expect to be second-half weighted in terms of revenue as has historically been the case, and given the promising sales pipeline for both of our businesses and this solid first half performance, the Board remains confident the business is in-line with achieving its full year expectations."

Financial Highlights

- Headline Group revenue of £15.3m, up 2.1% (H1 FY20: £15.0m), on a constant currency basis underlying growth was 3.8%

- The Group reported an adjusted profit before tax £1.3m (H1 FY20: £0.3m)

- Adjusted earnings per share 1.08p (H1 FY20: 0.17p)

- Continued cash generation with operating cashflow of £4.2m (H1 FY20: £1.0m)

- Strong balance sheet with no debt and cash of £15.9m as at 31 March 2021 (H1 FY20: £10.8m). Cash position at 25th May 2021 £19.1m

Operational Highlights

Strategy for Vicon: strengthen and grow profitable market leader

- Demand in the USA returned in the second quarter with solid performance in other geographies

- Continued traction in engineering: NASA's Vicon-equipped Jet Propulsion Lab developed the Ingenuity Mars Helicopter which performed its first flight on Mars on 19th April 2021

- Opportunity in virtual production has increased demand for Vicon tracking systems

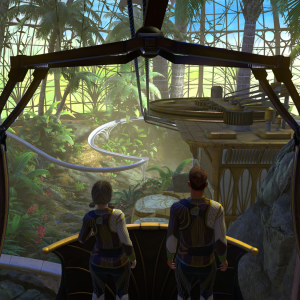

- Our partnership with industry leader Industrial Light & Magic (ILM) has taken virtual production to a new level in the most recent season of The Mandalorian, the highly successful new Star Wars production

- Partnership with the University of Portsmouth to support ground-breaking innovation in virtual, augmented and extended realties at their all-new Centre for Creative and Immersive Extended Reality (CCIXR)

- Vicon’s motion measurement technology continues to expand the range of measurement methods available launching a new integrated markerless capability powered by partner, Theia

- Return to more normal levels of market activity in Location-based Virtual Reality (LBVR) and Elite Sports

- Emerging opportunity for LBVR systems in Enterprise

- Secured renewals with MLB, NBA and NRL teams and new wins including a key European football club

Strategy for Yotta: enhance cloud-based software and grow recurring revenue

- Yotta software revenues up 11.1% to £4.1m (H1 FY20: £3.7m), as we continue to see customer interest to digitally transform the management of public assets

- Growth initiatives yielding results – improved visibility as Annualised Recurring Revenues (‘ARR’) grew 4.7% to £7.1m (H1 FY20: £6.8m)

- 97.5% (H1 FY20: 95.8%) retention of growing SaaS customer base

- Trend to seamlessly manage remote working helped secure sales wins at both larger and smaller Local Authorities including:

- Devon County Council and SSE to manage their street lighting

- A highly competitive open tender Alloy win with Halton Borough Council

- Record number of "go-lives" for Alloy with implementations at Ubico, Bristol Waste and Hackney

- Partner-centric approach gaining momentum with wins at four cities across Australia for Horizons

Outlook and Guidance

- Sales pipelines in both Vicon and Yotta are promising and, together with these interim results, the business is trading in-line with the Board’s full year expectations

- While Vicon is experiencing some extended lead-times on certain components due to global conditions, actions are being taken to avoid disruption to shipments in the second half

- ARR growth in the first half has been slowed by the UK national lockdown but additions at Yotta are expected to improve in the second half as trading conditions normalise

- Strong balance sheet puts the Group in a good position to adapt, innovate and navigate any further challenges that arise whilst driving organic and inorganic growth

For the full Interim Results click here.

Regulatory news

Regulatory news and AIM Rule 26 including corporate governance and significant shareholders

Company News

Dec 9, 2025

Audited Results for the financial year ended 30 September 2025

Jun 18, 2025

Interim Results for the six months ended 31 March 2025

Jun 2, 2025

Non-Executive Board Changes

Apr 25, 2025

H1 Trading Update and Board Change

Mar 28, 2025

Vicon’s new markerless system enabling Dreamscape's latest VR experience

Case studies

Read how our software is used in diverse applications world-wide