OMG plc (LSE: OMG), the technology group providing image understanding products for the entertainment, defence, life science and engineering industries, announces today the completion of the sale of its Californian-based wholly owned subsidiary House of Moves Inc. (“HOM”) for £0.8m pursuant to a HOM management-led buyout.

Under a share purchase agreement OMG will receive £0.8m cash consideration of which £0.3m is due on completion. The balance in deferred consideration will be spread in equal installments over the next four years.

During the first half of the 2014 financial year, the Group undertook a strategic review of HOM; a service based motion capture business. As a result, the Board determined that whilst HOM has an exciting future in content creation this no longer fits with the overall strategic direction of the Group, which is fundamentally a software and hardware technology business. At the time of the release of the interim results in June, the Board announced that negotiations for the sale of HOM were advanced having signed a non-legally binding letter of intent.

This sale concludes the divestment process of HOM. For the year ended 30 September 2013, HOM contributed revenues of £2.0m and a loss before tax of £0.7m. The total value of the assets disposed is £1.5m comprising £0.8m of goodwill and £0.7m of fixed and other assets. This transaction will generate a non-cash loss of approximately £0.7m which will be disclosed in the financial results for the year ending 30 September 2014. It is anticipated that this move will help to reduce the volatility of future profits reported by the Group and the cash received from the sale will be deployed to augment the Group’s working capital.

Nick Bolton, CEO of OMG plc said:

“This move is a step in the right direction as the Board continues to explore a range of opportunities to realise value in OMG’s IP, which may involve the licensing of certain technologies where external companies see value in deploying our IP to pursue their own business goals or, as in the case of House of Moves, the sale of certain assets, where we believe that greater shareholder value can be realised in the near term.”

Regulatory news

Regulatory news and AIM Rule 26 including corporate governance and significant shareholders

Company News

Jun 2, 2025

Non-Executive Board Changes

Apr 25, 2025

H1 Trading Update and Board Change

Mar 28, 2025

Vicon’s new markerless system enabling Dreamscape's latest VR experience

Mar 20, 2025

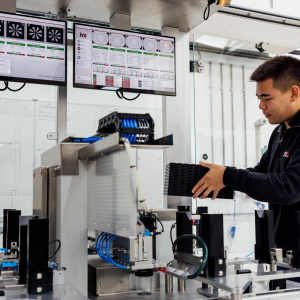

Continued momentum for smart manufacturing division

Mar 19, 2025

E2E Female 100

Case studies

Read how our software is used in diverse applications world-wide